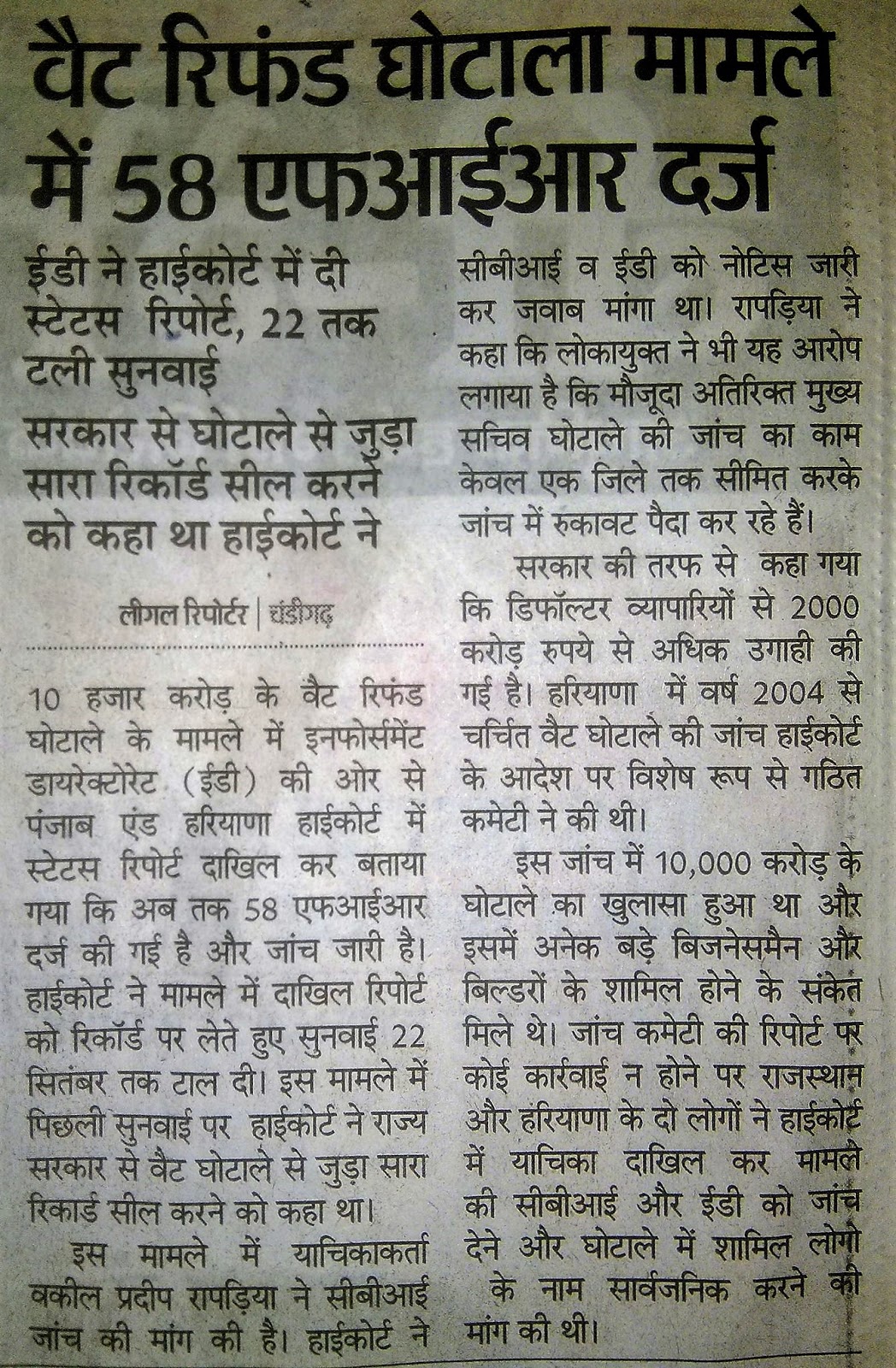

The case involving the scam of more than Ten Thousands

Crores Rupess, after 20 adjournments, has traveled to the Division Bench of the

Punjab & Haryana High Court. On Monday (07/08/2018) J. Jaswant Singh while

keeping in view the report of the HC Registry directed the matter to be listed

before the concerned Division Bench of the High Court. The Enforcement Directorate

(ED) has already registered the case for investigating the offences of Money

Laundering. The prayer for CBI

Investigation is still pending before the High Court. Justice Paramjeet Singh

Dhaliwal had issued notice to the effect:-

Now, Mr. Pardeep Rapria, Advocate for the Petitioners and whistle-blowers moved a miscellaneous application before the High Court while submitting that the matter relating to the investigation by ED are required to be listed before the division bench of the High Court. J. Jaswant Singh after obtaining the report of the Registrar directed the matter to be listed before the DB-3 of the High Court. Now, the matter has been posted for hearing on 20-08-2018.

It may be recalled that the

investigation by SIT conducted only in respect of 10 districts of Haryana

brought to surface a staggering figure of revenue loss to the tune of about

Rs.10,618 crores (Rs.Ten thousand six hundred eighteen crores) which in fact

necessitates action not only against the dealers/businessmen but also against

the Officers and officials responsible for criminal misconduct under the

Prevention of Corruption Act.

The

SIT Report consisting 345 pages was submitted on 14.01.2015 but the Haryana

Government did not take any action. The petitioner’s counsellor has attached

the file notings of Chief Minister Manohar Lal Khattar and Finance Minister

Captain Abhimanyu and raised the question over the laxity of government in taking

action in the matter and which appears to be shielding the accused.

“The

accused officials of Excise and taxation department have close connections with

senior bureaucrates, police officers and politicians of different political

parties in Haryana”, contended the petitioner’s counsel Pardeep Rapria.

The rice processors of

Haryana may also face the music as their names have also been indicted in the

SIT report.

It

was noticed by the SIT during enquiry that officers of Excise & Taxation

Department, Haryana, at all levels in connivance with the traders and

builders/developers caused huge loss to the state. The system of Tax

Evasion/Refund by corrupt means is a well established and unofficially approved

system which is mutually beneficial to the excise and taxation officers and

traders and builders and hence nobody wants to disturb this convenient

system....”

The

SIT Lokayukta also mentioned “A number of other cases of builder/developer

could not be examined due to non co-operation on part of the District Excise

and Taxation Commissioners of Gurgaon and Faridabad, which confirms the

allegations of the complainant that these builder/developers have not paid the

Sales Tax/VAT as applicable on sales of flats/shops to prospective buyers. An

estimated loss of about Rs. 10,000 Crores is involved in the files....

The

SIT also felt that since the tax evasion scandal involves big names and affirms

and cannot be going on without active support of Excise & Taxation Officers

at all levels as it also involves jurisdictional issues as it demands enquiry

in Delhi, Rajasthan, Punjab and other states, it would be appropriate if this

matter is investigated by an agency like CBI”

No comments:

Post a Comment